DRAG DROP -

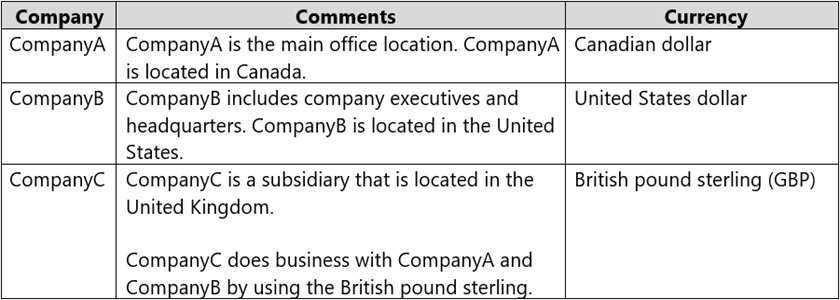

You are implementing Dynamics 365 Finance and have deployed one instance with the following legal entities:

You need to configure the ledger.

Which ledger currencies should be configured? To answer, drag the appropriate currency type to the ledger currency. Each currency type may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

Select and Place:

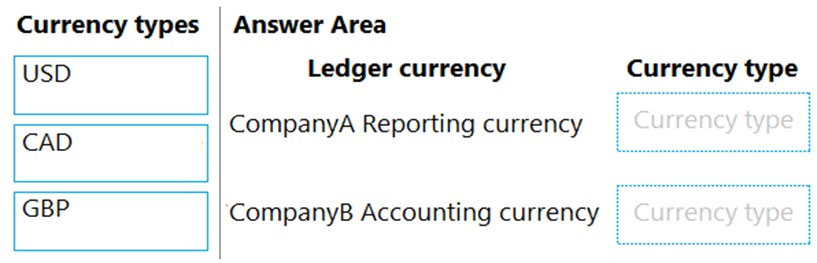

Answer:

Box 1: CAD -

Reporting currency is the currency used for operational reporting to the government bodies.

Accounting currency is what your legal entity uses for amounts calculation. It is unique per the legal entity. Reporting currency is the currency used for operational reporting to the government bodies

Box 2: GBP -

Accounting currency is what your legal entity uses for amounts calculation. It is unique per the legal entity.

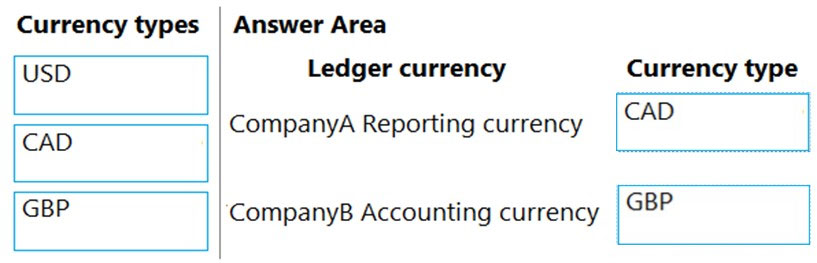

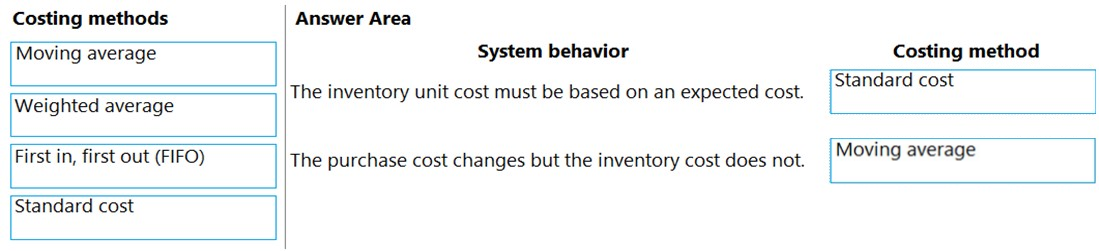

DRAG DROP -

You are implementing Dynamics 365 Finance.

You must associate items with an item model group. An inventory close must not be required.

You need to configure the item model group.

Which costing method should you use? To answer, drag the appropriate costing method to the correct system behavior. Each costing method may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

Select and Place:

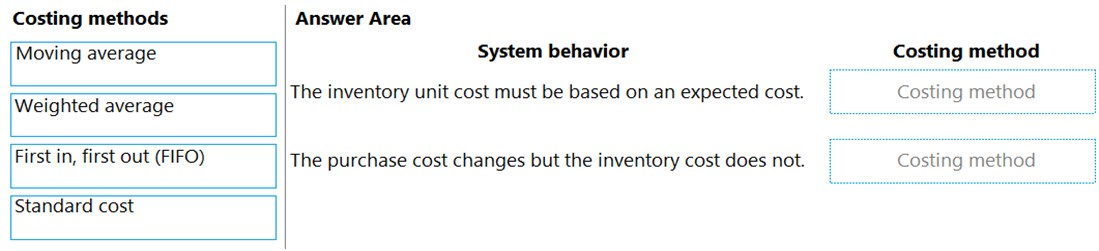

Answer:

Box 1: Standard cost -

Standard costs are estimates of the cost of goods sold -- that is, the cost required to produce your products. They usually consist of three parts: direct materials, direct labor, and manufacturing overhead.

Box 2: Moving average -

Moving average is a perpetual costing method based on the average principle, where the costs on inventory issues do not change when the purchase cost does.

Incorrect:

* Weighted average is an inventory model based on an average that results from the multiplication of each component (item transaction) by a factor (cost price) reflecting its importance (quantity). Another way to say this is that weighted average is an inventory model that assigns the cost of issue transactions based on the mean value of all inventory received during the period, plus any on-hand inventory from the previous period.

* First in, First out (FIFO) is an inventory model in which the first acquired receipts are issued first. Financially updated issues from inventory are settled against the first financially updated receipts into inventory, based on the financial date of the inventory transaction.

Reference:

https://www.fool.com/the-ascent/small-business/accounting/articles/standard-cost/ https://docs.microsoft.com/en-us/dynamics365/supply-chain/cost-management/moving-average

You are implementing Dynamics 365 Finance.

You must configure a more accurate cash flow forecast related to sales tax. The sales tax calculation should be based on the expected transaction amounts and dates.

You need to configure the cash flow forecast.

Which setup should you use?

Answer:

B

Cash flow forecasting can be integrated with General ledger, Accounts payable, Accounts receivable, Budgeting and inventory management. The forecasting process uses transaction information that is entered in the system, and the calculation process forecasts the expected cash impact of each transaction.

Note: In the Purchasing forecast defaults section, you can select default purchasing behaviors for cash flow forecasting. Three fields determine the time of the cash impact: Time between delivery date and invoice date, Terms of payment, and Time between invoice due date and payment date. The forecast will use the default setting for the Terms of payment field only if a value isn't specified on the transaction. Use a term of payment to describe the most typical number of days for each part of the process.

Sales tax authority payments -

The Cash flow sales tax authority payments feature predicts the cash flow impact of sales tax payments. It uses unpaid sales tax transactions, tax settlement periods, and the tax period payment term to predict the date and amount of cash flow payments.

Incorrect:

Not A: A bridged payment is a payment that is posted to the general ledger in two steps. Typically, this approach is used when the method of payment is set to

Bank, and you must post transactions to the bank account only when the transaction has cleared the bank.

Not B: If your organization has configured multiple forecasts, save your users time and select one to be displayed by default when they open the Forecasts page.

With Dynamics 365 Sales forecasting, we are introducing a new set of capabilities that empower organizations to natively create and manage bottom-up sales forecast processes.

Accurate forecasting helps everyone on the team:

Sellers can manage their pipeline and focus time more effectively, by identifying the deals they need to close to meet quotas.

Sales managers and leaders can plan sales team execution and meet sales forecasts more confidently with greater flexibility and a clearer view into bottom-up projections, all the while gaining a deeper understanding of those opportunities that impact the business.

Sales enablement managers can benefit from greater flexibility to offer more granular and meaningful guidance that accurately reflects sales execution.

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/cash-bank-management/cash-flow-forecasting https://docs.microsoft.com/en-us/dynamics365-release-plan/2020wave1/dynamics365-sales/forecasting

You plan to manage delinquent customers by monitoring the collection process in Dynamics 365 Finance.

You need to use the Collections list page to monitor the collection process.

What must you do first?

Answer:

B

Collections customer pools -

Customer pools are queries that define a group of customer records. You can use these grouped records to view information for the customer accounts that are included, and to manage collections or aging processes for them. You can use customer pools to filter information on the collections list pages. You also can use them to filter the customer accounts that are included when aging snapshots are created.

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/accounts-receivable/cm-collections-concepts

You are the controller of a multi-entity organization that uses the same chart of accounts and fiscal periods across all entities. You use the financial report designer in Dynamics 365 Finance to create, maintain, deploy, and view financial statements.

You need to generate consolidated financial statements by using a building block group to aggregate data across companies and financial dimensions.

Which three actions should you perform? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

Answer:

BCD

Single-level and multilevel consolidations across legal entities

The simplest method for consolidating by using Financial reporting is to use reporting trees to aggregate data across companies that have the same chart of accounts and fiscal periods. Here are the high-level steps to consolidate by using a reporting tree.

1. Create a row definition, and make sure that all appropriate accounts in all companies are included in the rows. (B)

2. Create a column definition that includes all the columns that are required for the report that you're creating. (C)

3. Create a reporting tree that includes a reporting node for each company that you're using on consolidated reports. (D)

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/generating-consolidated-financial-statements

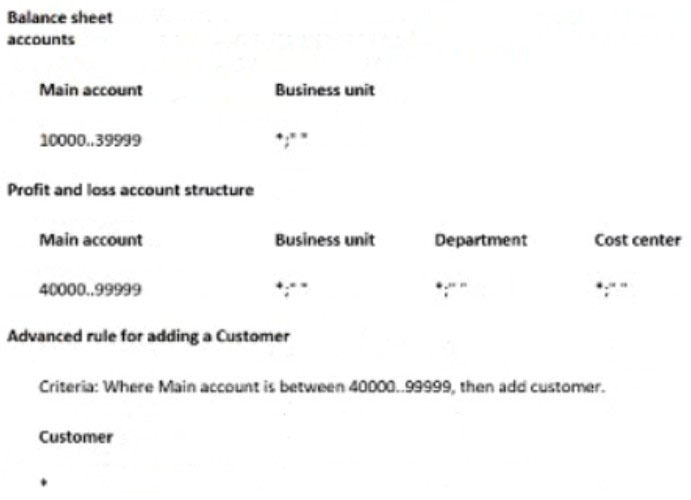

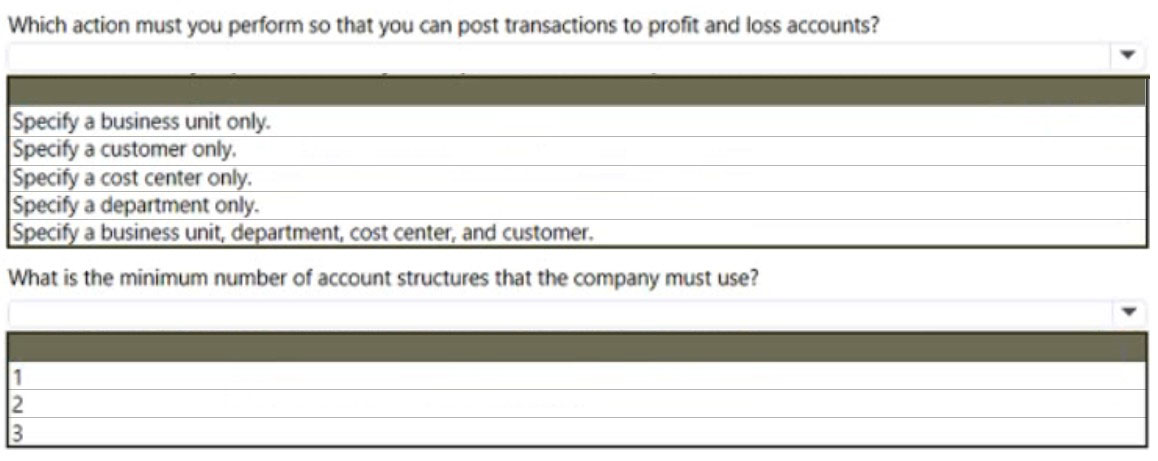

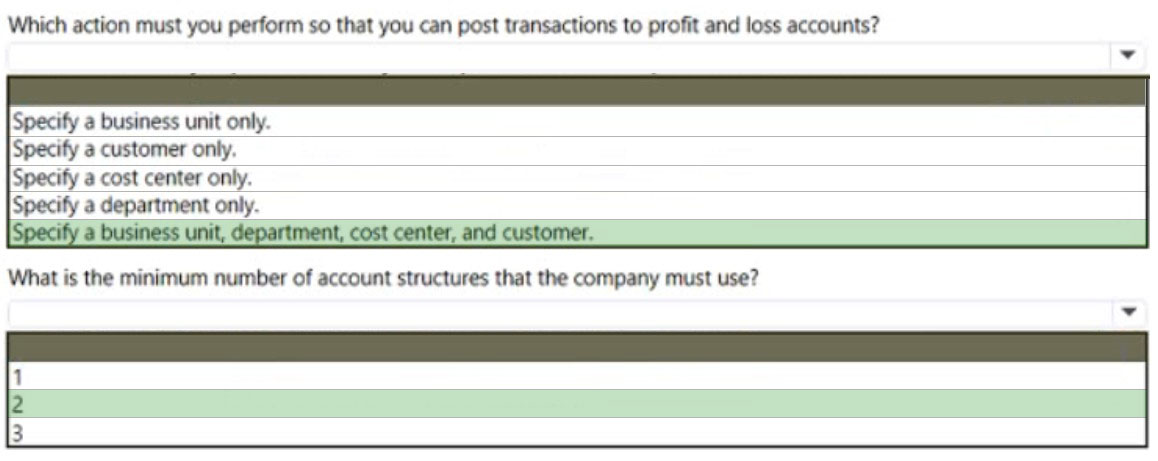

HOTSPOT -

A company wants to track balance sheet accounts 10000..39999 by using different dimensions than their profit and loss accounts 40000..99999. The company wants to track the Customer financial dimension for profit and loss accounts.

The company sets up the following structure:

Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic.

NOTE: Each correct selection is worth one point.

Hot Area:

Answer:

Box 1: Specify a business unit, department, cost center, and customer.

Example -

To illustrate a best practice for setting up an account structure, let's assume that a company wants to track their balance sheet accounts (100000..399999) at the account and business unit financial dimension level. For revenue and expense accounts (400000..999999), they track financial dimensions Business Unit,

Department, and Cost center. If they make a sale, they also like to track Customer. Using this scenario, it would be recommended to have two account structures assigned to the company's ledger - one for Balance sheet accounts, and one for Profit and Loss accounts. To optimize the user experience and validation,

Customer should be an advanced rule that is only used when a sales account is used.

Box 2: 2 -

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/configure-account-structures

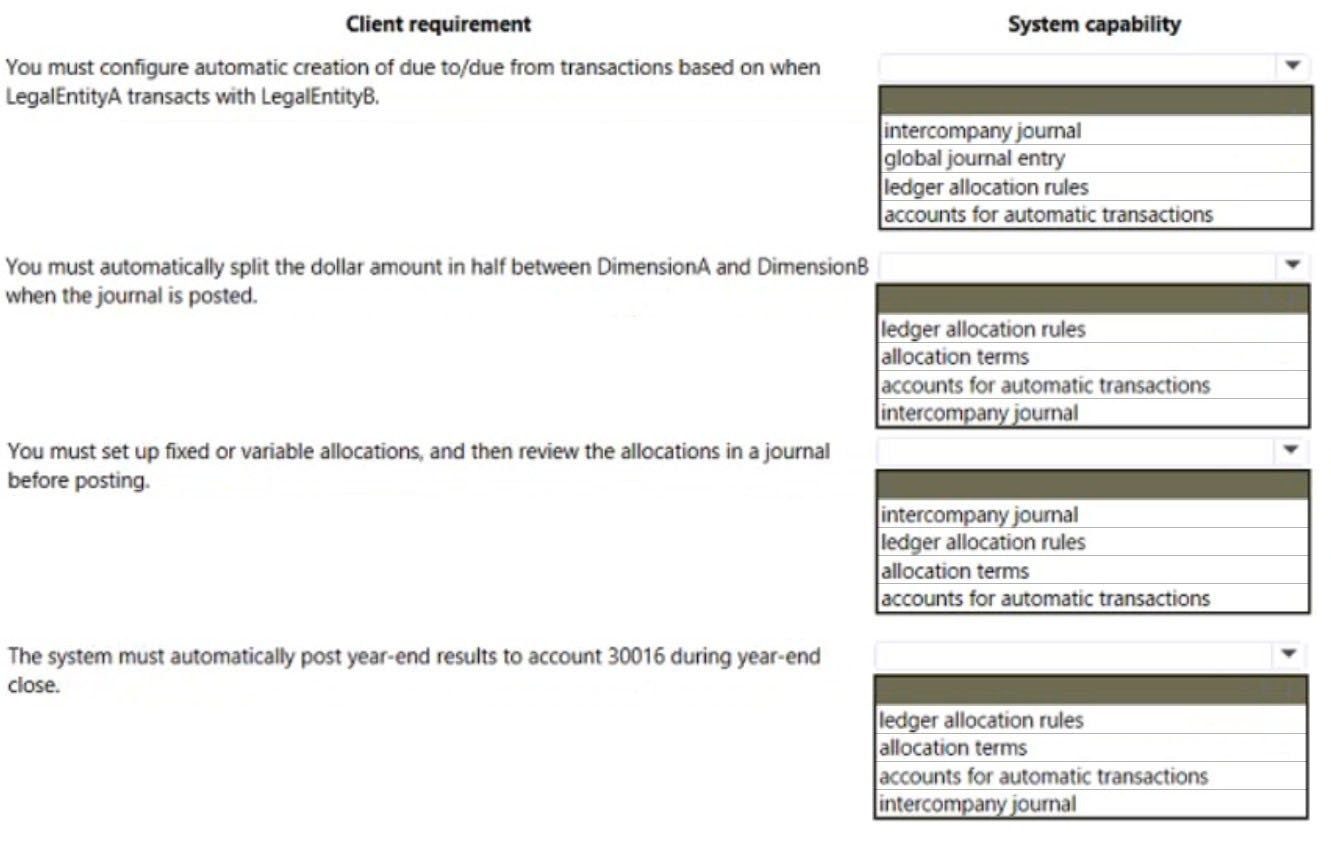

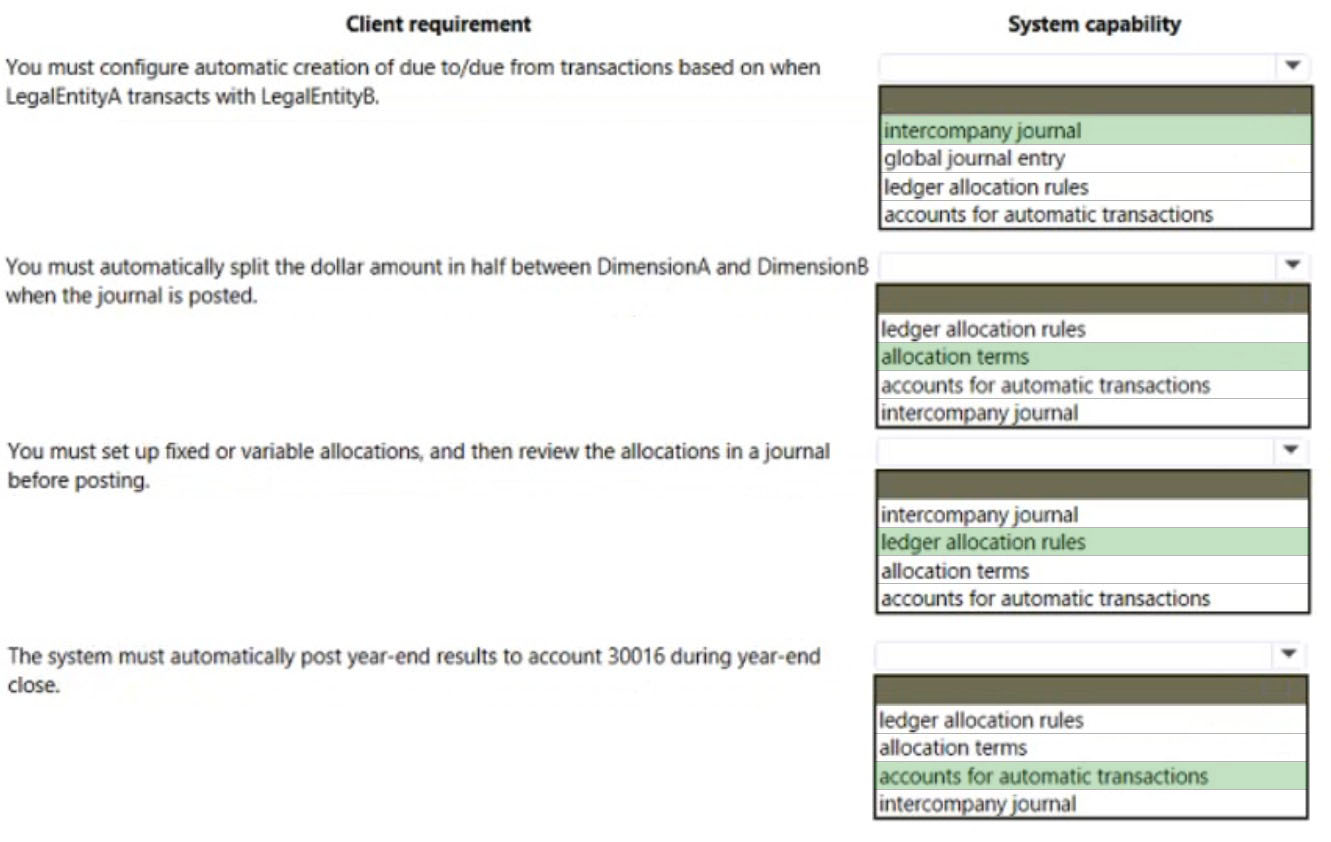

HOTSPOT -

You are implementing a Dynamics 365 Finance general ledger module for a client that has multiple legal entities.

The client has the following requirements:

✑ Post journal entries for all companies from one legal entity.

✑ Configure automatic creation of due to/due from transactions based on when LegalEntityA transacts with LegalEntityB.

✑ Automatically split the dollar amount in half between DimensionA and DimensionB when the journal is posted.

✑ Set up fixed or variable allocations, and then review the allocations in a journal before posting.

✑ Automatically post yearend results to account 30016 during yearend close.

You need to configure the system.

Which system capability should you configure? To answer, select the appropriate configuration in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

Answer:

Box 1: intercompany journal -

Box 2: allocation terms -

Allocation terms are used to distribute amounts across multiple ledger account combinations. They help ensure that expenses or revenues are charged to the correct object in accounting.

Box 3: ledger allocation rules -

Box 4: accounts for automatic transactions

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/main-account-allocation-terms

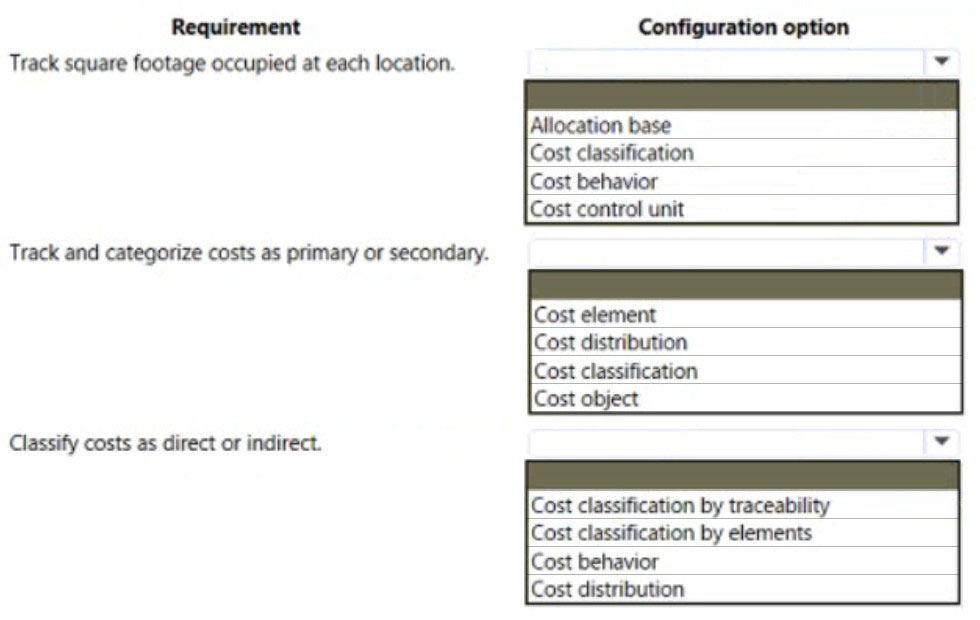

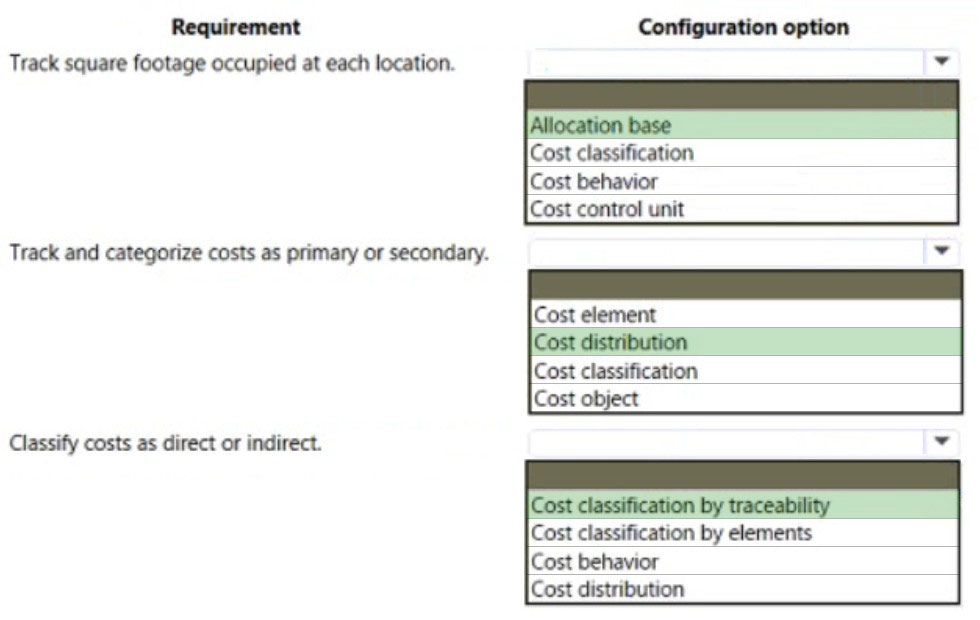

HOTSPOT -

A customer implements Dynamics 365 Finance.

The customer needs to use the cost accounting module for the following:

✑ Track the square footage occupied at each of the customer's store locations.

✑ Track and categorize costs as primary or secondary.

✑ Classify costs as direct or indirect

You need to configure the system.

NOTE: Each correct selection is worth one point.

Hot Area:

Answer:

Box 1: Allocation base -

The allocation base is used to measure and quantify activities, such as machine hours that are used, kilowatt hours that are consumed, or square footage that is occupied. It's used as basis for allocating costs to one or more cost objects.

Box 2: Cost distribution -

Is used to distribute cost from one cost object to one or more other cost objects by applying a relevant allocation base. Cost distribution and cost allocation differ in that cost distribution always occurs at the level of the primary cost element of the original cost and no reciprocal processing.

Box 3: Cost classification by traceability

Cost classification -

Cost classification groups costs according to their shared characteristics. For example, costs can be grouped by elements, traceability, and behavior.

By elements ג€" Materials, labor, and expenses.

By traceability ג€" Direct costs and indirect costs. Direct costs are assigned directly to cost objects. Indirect costs aren't directly traceable to cost objects. Indirect costs are allocated to cost objects.

By behavior ג€" Fixed, variable, and semi-variable.

Incorrect:

* Cost control unit

The cost control unit represents the cost structure. The structure determines how cost flows in a hierarchical order between cost object dimensions and their respective cost objects.

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/cost-accounting/terms-cost-accounting

An exchange rate provider has been configured for Dynamics 365 Finance.

Foreign currency transactions using the Euro and the US dollar use a fixed exchange rate for European Central Bank holidays and all days between April 1 and

June 30. Foreign currency transactions from March 1 to June 30 fail to post.

You need to reconfigure the system to post transactions for this period.

Which two configuration changes should you make to the ledgers? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

Answer:

CD

Multiple records in different transaction currencies can be aggregated, compared, or analyzed with regard to a single currency, by using an exchange rate. This is known as the base currency. You first define a base currency for the organization and then define exchange rates to associate the base currency with transaction currencies. The base currency is the currency in which other currencies are quoted. The exchange rate is the value of a transaction currency equal to one base currency.

Incorrect:

Not E: Prevent import on national holiday- This check box manages the import of the exchange rate for public holiday's date. For example, if you select this check box and use the European Central Bank as the exchange rate provider, the system will not update the exchange rate on a public holiday that is related to the current legal entity. This option might not be available for some providers.

Reference:

https://docs.microsoft.com/en-us/dynamics365/customerengagement/on-premises/developer/transaction-currency-currency-entity

A company manufactures air filtering units for industrial manufacturing plants.

During the acquisition of one of the components that is used in the unit an agreement is reached that the $25,000 component will be paid for in the following schedule:

✑ The first payment will be $10,000.

✑ The remaining balance will be distributed equally and due on the 15th of the month for the next three months.

You need to configure the system for the payment schedule.

What should you do?

Answer:

D

Note: Set up payment schedules with TDS allocation

1. Go to Accounts payable > Payment setup > Payment schedules.

2. On the Action Pane, select New to create a payment schedule, and enter the required details.

3. In the Allocation field, select the method to use to allocate the payment for the payment schedule: a) Total ג€" One total amount b) Fixed amount ג€" Due divided on a specified fixed amount c) Fixed quantity ג€" Due divided in specified no of installments d) Specified ג€" Unproportionate amount in unproportionate no of interval

4. Enter the other required details, and then close the page.

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/localizations/apac-ind-tds-payment-schedule-setup-with-tds-allocation