HOTSPOT -

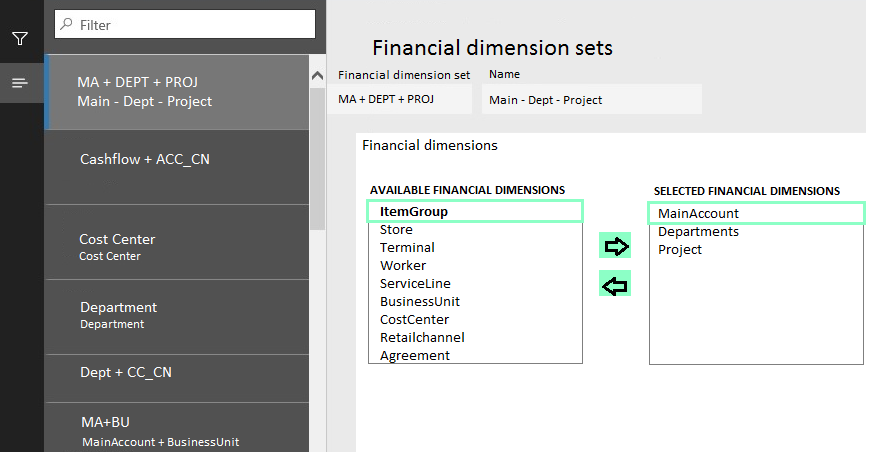

You create a financial dimension set named MA + DEPT + PROJ as shown in the following screenshot. The financial dimension set includes the following dimensions:

✑ Main Account

✑ Department

Project -

Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic.

Hot Area:

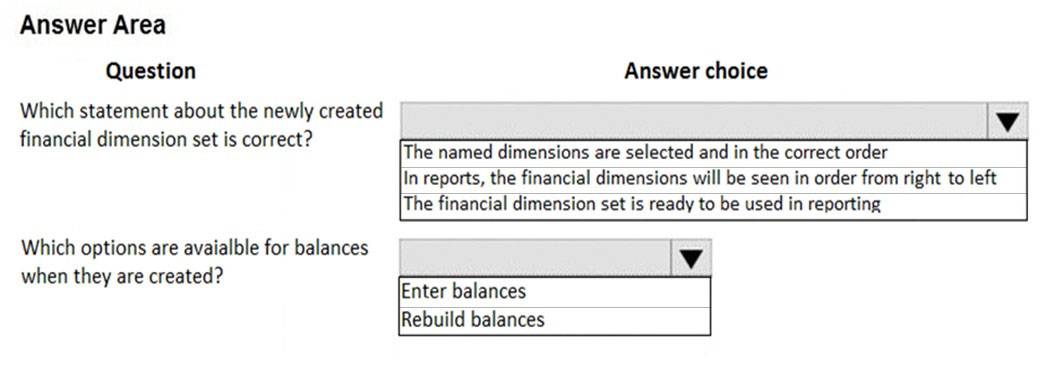

Answer:

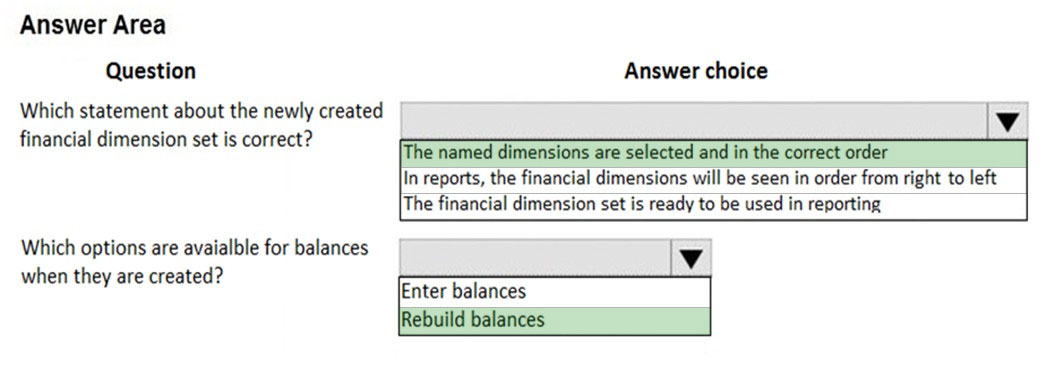

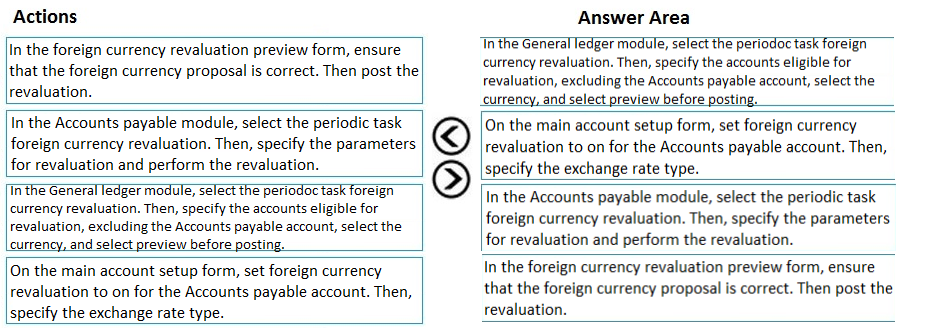

DRAG DROP -

A client has Accounts payable invoices in their legal entity in three different currencies. It is month-end, and the client needs to run the foreign currency revaluation process to correctly understand their currency exposure.

You need to set up Dynamics 365 Finance to perform foreign currency revaluation.

In which order should you perform the actions? To answer, move all actions from the list of actions to the answer area and arrange them in the correct order.

NOTE: More than one order of answer choices is correct. You will receive credit for any of the correct orders you select.

Select and Place:

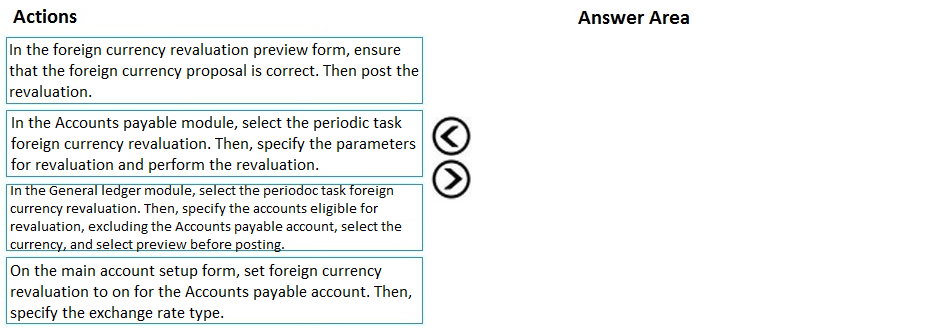

Answer:

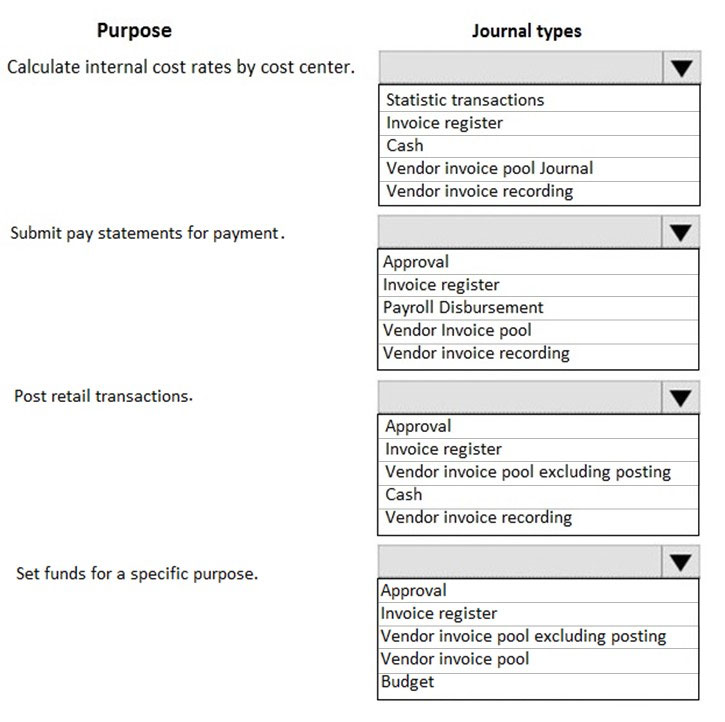

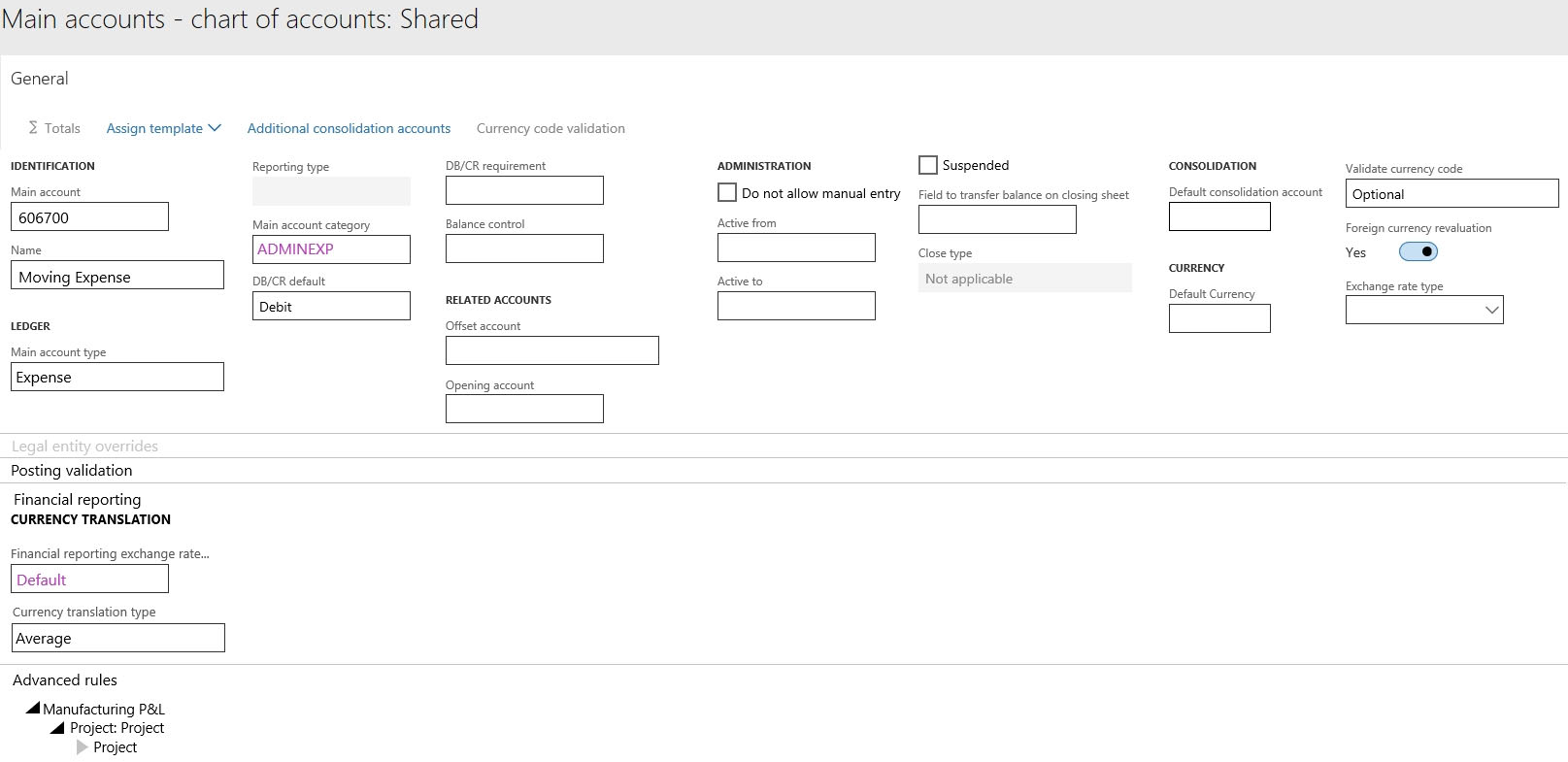

HOTSPOT -

A company is using vendors to produce components for its products.

Journal types are not configured to support vendor invoices.

You need to identify and configure journals to use for vendor invoices.

Which journal types should you use? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

Answer:

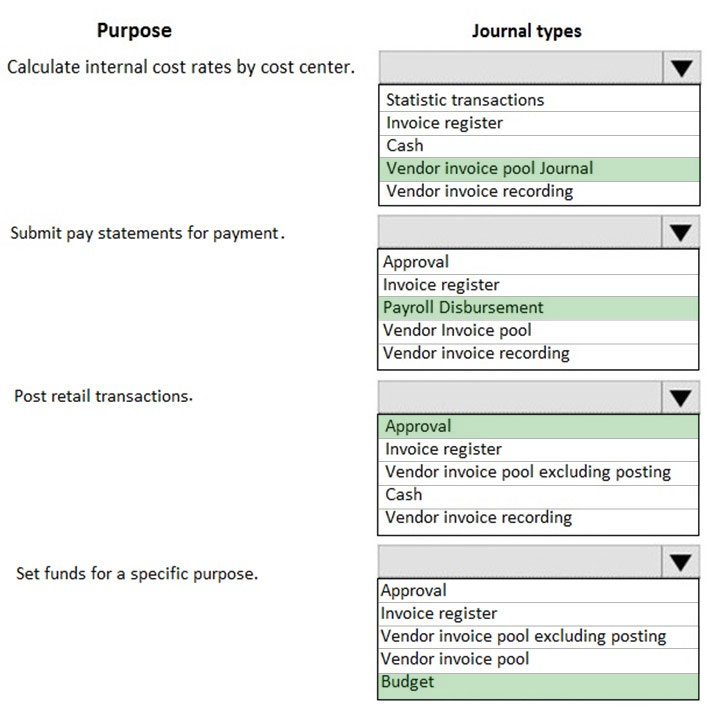

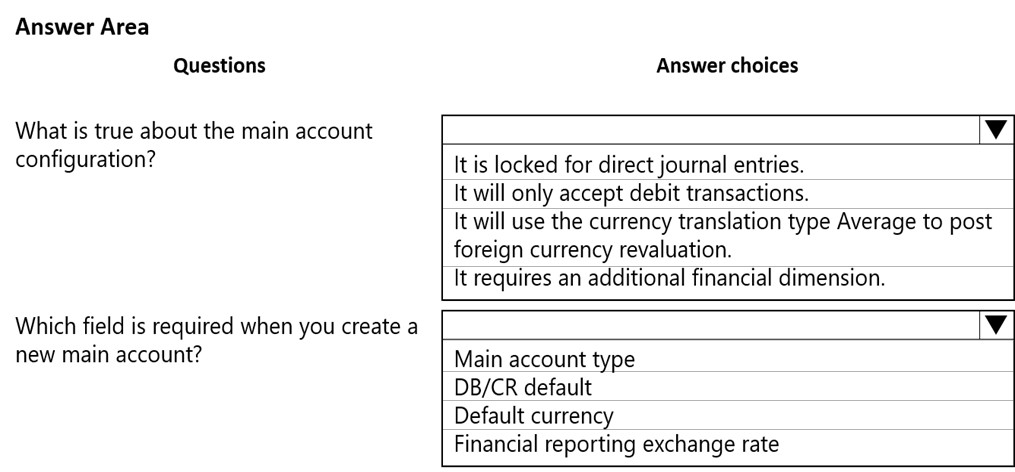

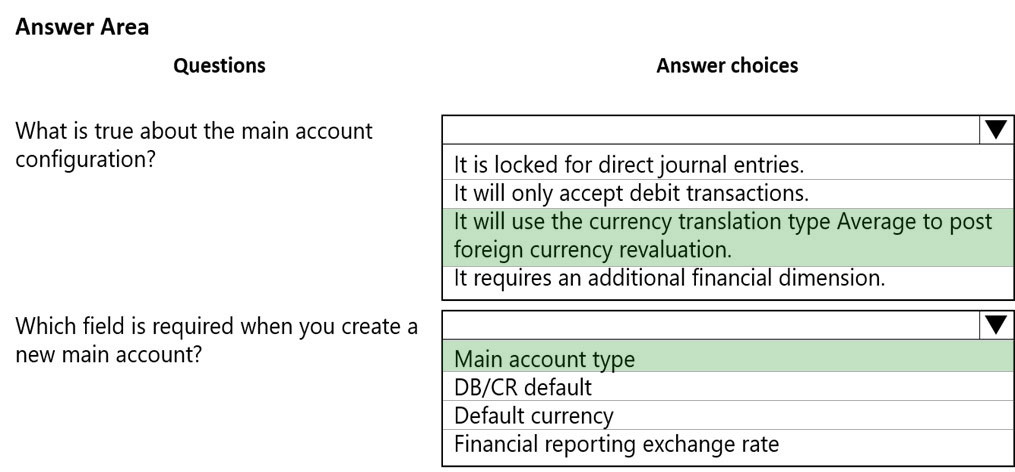

HOTSPOT -

You are asked to configure a main account in Dynamics 365 Finance.

Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic.

NOTE: Each correct selection is worth one point.

Hot Area:

Answer:

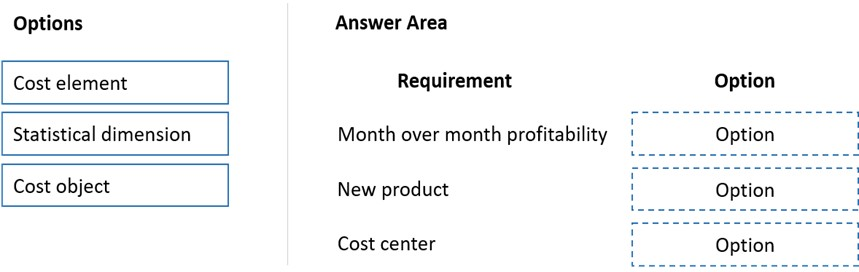

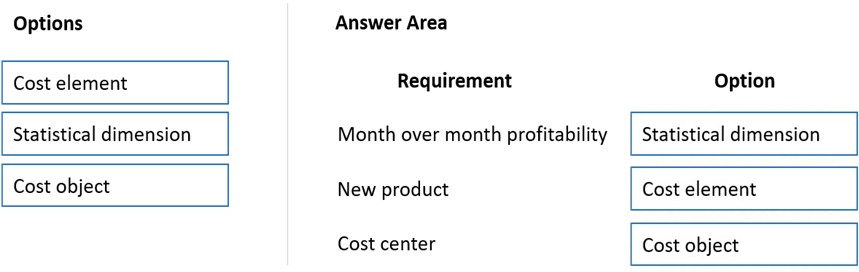

DRAG DROP -

You are implementing Dynamics 365 Finance. A new product is being released.

The system must track the probability of the new product by cost center and you must use the cost control workspace.

You need to configure the system.

Which option should you use? To answer, drag the appropriate option to the correct requirement. Each value may be used once, more than once, or not at all.

You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

Select and Place:

Answer:

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/cost-accounting/terms-cost-accounting

Manual entry of currency exchange rates must be discontinued. Currency exchange rates must use the current rate values provided by the European Central

Bank. The exchange rate entries and updates must be automated.

You need to configure the system.

Which two options should you use? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

Answer:

AE

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/import-currency-exchange-rates

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A client has one legal entity, two departments, and two divisions. The client is implementing Dynamics 365 Finance. The departments and divisions are set up as financial dimensions.

The client has the following requirements:

✑ Only expense accounts require dimensions posted with the transactions.

✑ Users must not have the option to select dimensions for a balance sheet account.

You need to configure the ledger to show applicable financial dimensions based on the main account selected in journal entry.

Solution: Configure one account structure for expense accounts and include applicable dimensions.

Does the solution meet the goal?

Answer:

B

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/configure-account-structures

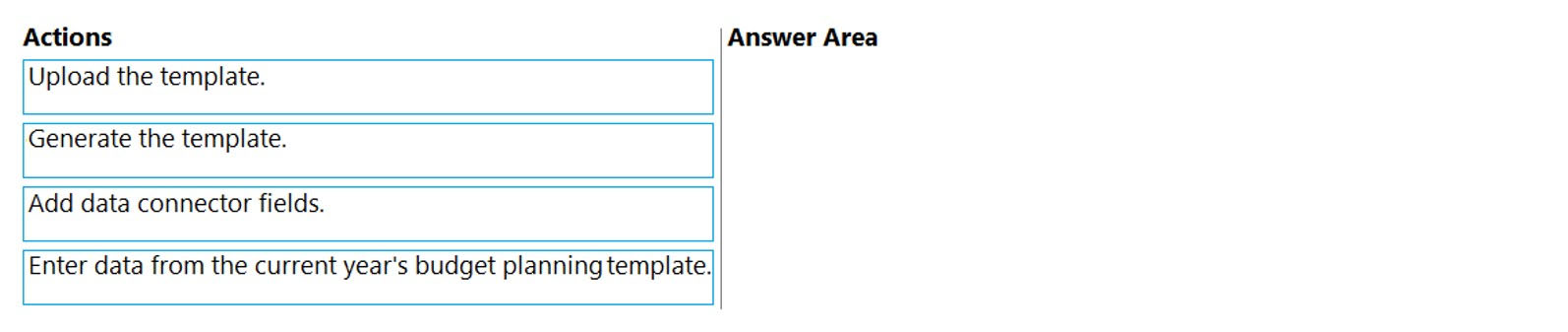

DRAG DROP -

You are using Microsoft Excel to complete budget planning for the next fiscal year.

Budget template data must be gathered in real time from Dynamics 365 Finance during the budget planning process.

You need to create a budget planning template by using Microsoft Excel.

Which three actions should you perform in sequence? To answer, move the appropriate actions from the list of actions to the answer area and arrange them in the correct order.

Select and Place:

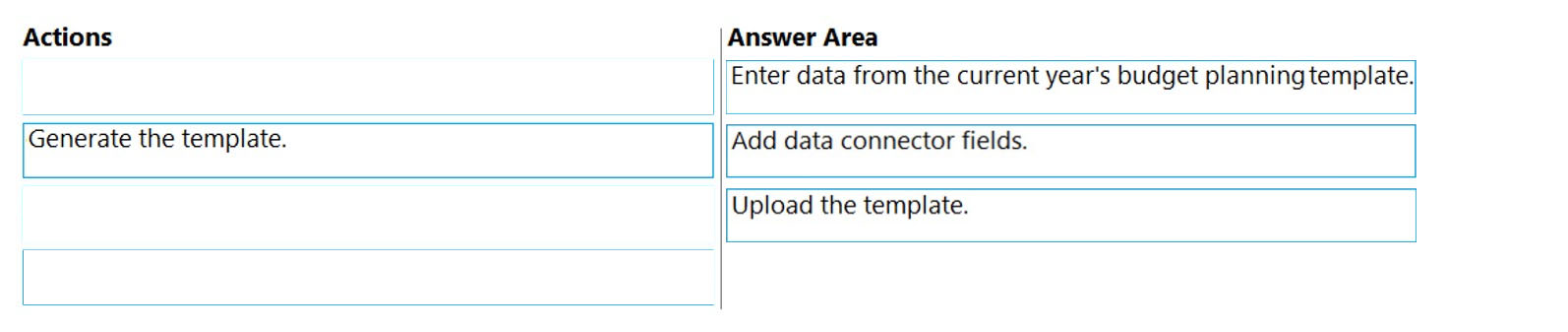

Answer:

Step 1: Enter data from the current year's budget planning template.

Create a new template from existing data

Step 2: Add data connector fields.

Microsoft Excel can change and quickly analyze data. The Excel Data Connector app interacts with Excel workbooks and OData services that are created for publicly exposed data entities. The Excel Data Connector add-in enables Excel to become a seamless part of the user experience. The Excel Data Connector add-in is built by using the Office Web add-ins framework.

Step 3: Upload the template.

When you have your Excel template customized the way you want, you can upload it into Dynamics 365. Where you upload the template determines its availability.

Reference:

https://docs.microsoft.com/en-us/dynamics365/fin-ops-core/dev-itpro/office-integration/office-integration https://portal.dynamics365support.com/knowledgebase/article/KA-01250/en-us

You need to configure cash flow reports.

Which three actions should you perform? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

Answer:

ABE

To obtain a forecast of the cash flow, you must complete the following tasks:

* Identify and list all the liquidity accounts. Liquidity accounts are the company's accounts for cash or cash equivalents.

* Configure the behavior for forecasts of transactions that affect the company's liquidity accounts.

After you've completed these tasks, you can calculate and analyze forecasts of the cash flow and upcoming currency requirements.

The forecasting process uses transaction information that is entered in the system, and the calculation process forecasts the expected cash impact of each transaction.

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/cash-bank-management/cash-flow-forecasting

You are implementing Dynamics 365 Finance.

Sales tax payable must be posted to the same collection of accounts across all legal entities.

You need to configure the sales tax.

What should you use?

Answer:

A

You can set up Ledger posting groups for sales tax.

Sales tax is calculated and posted to main accounts that are specified in Ledger posting groups. Ledger posting groups are attached to each sales tax code. You can set up individual ledger posting groups for each sales tax code, use one ledger posting group for all sales tax codes or assign multiple ledger posting groups to the sales tax codes.

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/tasks/set-up-ledger-posting-groups-sales-tax