Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution. Determine whether the solution meets the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A customer uses Dynamics 365 Finance.

The controller notices incorrect postings to the ledger entered via journal.

The system must enforce the following:

✑ Expense accounts (6000-6998) require department, division, and project with all transactions. Customer dimension is optional.

✑ Revenue accounts (4000-4999) require department and division and allow project and customer dimensions.

✑ Liability accounts (2000-2999) should not have any dimensions posted.

✑ Expense account (6999) requires department, division, project and customer dimensions with all transactions.

You need to configure the account structure to meet the requirements.

Solution:

✑ Configure two account structures.

✑ For Expense Accounts (6000-6998), configure asterisks in department division, and project. Configure an asterisk and quotations in customer dimension.

✑ For Revenue accounts (4000-4999), configure asterisks in department and division. Configure an asterisk and quotations in project and customer dimensions.

✑ For Expense account (6999), configure asterisks in department division, project, and customer dimensions.

✑ Liability accounts (2000-2999) are in the second account structure with no following dimensions.

Does the solution meet the goal?

Answer:

A

Expense accounts (6000-6998) require department, division, and project with all transactions. Customer dimension is optional.

Solution: For Expense Accounts (6000-6998), configure asterisks in department division, and project. Configure an asterisk and quotations in customer dimension

Revenue accounts (4000-4999) require department and division and allow project and customer dimensions.

Solution: or Revenue accounts (4000-4999), configure asterisks in department and division. Configure an asterisk and quotations in project and customer dimensions.

Liability accounts (2000-2999) should not have any dimensions posted.

Solution: Liability accounts (2000-2999) are in the second account structure with no following dimensions.

Expense account (6999) requires department, division, project and customer dimensions with all transactions.

Solution: For Expense account (6999), configure asterisks in department division, project, and customer dimensions.

Also included in the solution: Configure two account structures.

A company uses Dynamics 365 Finance. The company is based in the United States and sells a product online. The product is shipped to the United States,

Canada, and Mexico. The product is sourced from Brazil.

Legal entities must be set up for each country/region. One ledger account must be used to track sales tax payable.

You need to configure the system to track Use Tax.

Which two parameters should you configure? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

Answer:

BE

B: Set up ledger posting groups for sales tax. Required. Ledger posting groups define the main accounts for recording and paying sales taxes.

E: Set up sales tax codes. Required. Sales tax codes contain the tax rates and calculation rules for each sales tax. Sales tax codes are related to a sales tax settlement period and a ledger posting group.

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/indirect-taxes-overview

The controller at a company has multiple employees who enter standard General ledger journals. The controller wants to review these journal entries before they are posted. Currently, journals entries are posted without review.

You need to configure Dynamics 365 Finance to help set up a system led review process to meet the controller s needs.

Which functionality should you configure?

Answer:

A

Some organizations require that journals be approved by a user other than the person who entered the journal. To set up an approval process, you can create a workflow.

A workflow represents a business process. It defines how a document flows through the system and indicates who must complete a task or approve a document.

Reference:

https://docs.microsoft.com/en-us/dynamicsax-2012/appuser-itpro/set-up-general-ledger-workflows

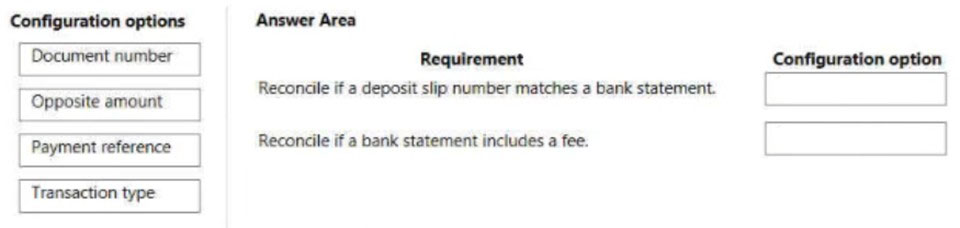

DRAG DROP -

A customer implements Dynamics 365 Finance.

You need to configure bank reconciliation settings.

What should you do? To answer, drag the appropriate configuration options to the correct requirements. Each configuration option may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

Select and Place:

Answer:

Box 1: Payment reference -

Deposit slip and bridged transactions to address bank/card/payment provider fees in bank statement and bank reconciliation in Microsoft Dynamics 365 Finance and Operations

Steps -

Create general journal -

Load bridge transactions -

Create additional journal line and provide the account for fees and use offset as bank as previous line

* enable deposit slip on both lines and use same payment reference after posting journal use functions to prepare deposit slip after generating deposit slip check bank statement and bank transactions

Box 2: Transaction type -

Create transactions for entries, such as fees and interest, that are on the bank statement but that are not recorded in Finance. Enter the Bank transaction type and appropriate financial dimensions.

Reference:

https://community.dynamics.com/ax/b/happyd365fo/posts/deposit-slip-and-bridged-transactions-to-address-bank-card-oayment-provider-fees-in-bank- statement-and-bank-reconciliation-in-microsoft-dynamics-365-finance-and-operations https://docs.microsoft.com/en-us/dynamics365/finance/cash-bank-management/reconcile-bank-account

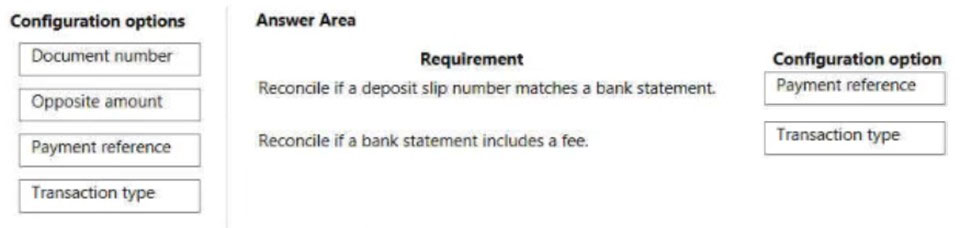

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

A client wants general journals to be used only to post ledger-type transactions.

You need to set up journal configuration to achieve the requirement.

Solution: Set up a default offset account on the journal name.

Does the solution meet the goal?

Answer:

B

Instead Solution: Set up the journal control to specify the account structure and ledger segment.

A journal name can be used only for adjustments. In this case, you can specify that only the Ledger account type is valid across all companies.

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/general-ledger/general-journal-processing

A client has unique accounting needs that sometimes require posting definitions.

You need to implement posting definitions.

In which situation should you implement posting definitions?

Answer:

D

An organization is setting up a cost accounting.

You need to set up fiscal calendars for Dynamics 365 Finance.

What are three uses for fiscal calendars? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

Answer:

BCD

Reference:

https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/budgeting/fiscal-calendars-fiscal-years-periods

You are configuring automatic bank reconciliation functionality for a company that has multiple bank accounts. The company wants to import their bank statements.

You need to import electronic bank statements to reconcile the bank accounts.

Which three actions can you perform? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

Answer:

BDE

Reference:

https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/cash-bank-management/reconcile-bank-statements-advanced-bank-reconciliation

A company plans to create a new allocation rule for electric utilities expenses.

The allocation rule must meet the following requirements:

✑ Distribute overhead utility expense to each department.

✑ Define how and in what proportion the source amounts must be distributed on various destination lines.

You need to configure the allocation rule.

Which allocation method should you use?

Answer:

D

Reference:

https://docs.microsoft.com/en-us/dynamics365/unified-operations/financials/general-ledger/ledger-allocation-rules

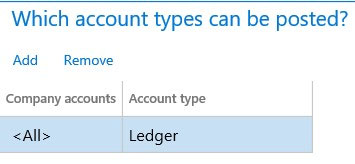

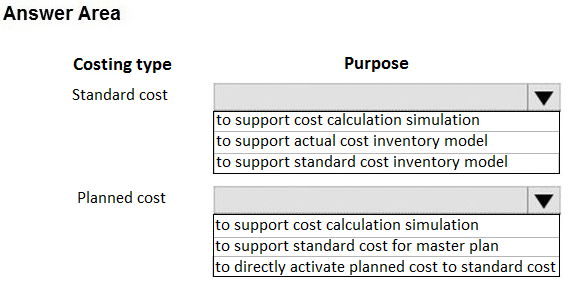

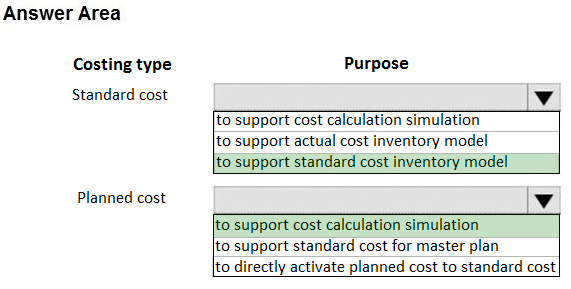

HOTSPOT -

A food manufacturer uses commodities such as beans, corn, and chili peppers as raw materials. The prices of the commodities fluctuate frequently. The manufacturer wants to use cost versions to simulate these fluctuations.

You need to set up cost versions and prices to accomplish the manufacturer's goal.

For which purpose should you use each costing type? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

Answer:

Reference:

https://docs.microsoft.com/en-us/dynamics365/unified-operations/supply-chain/cost-management/costing-versions