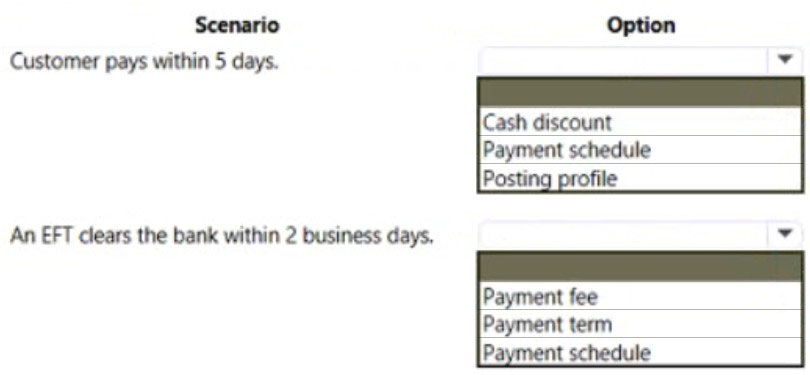

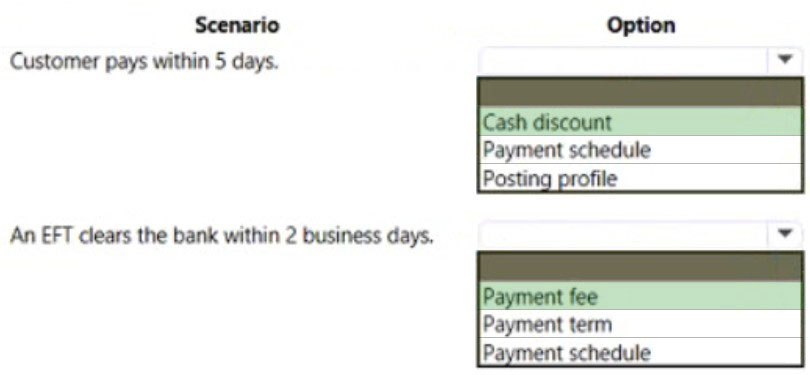

HOTSPOT -

A company manufactures air filtering units for industrial manufacturing plants.

The company offers specific incentives if customers pay within a certain number of days to include:

✑ 10 percent off if paid in full within 5 days

✑ 5 percent off if paid in full within 10 days

Customers who pay by electronic funds transfer (EFT) will be charged $15 per transfer.

You need to configure the system.

Which option should you use? To answer, select the appropriate configuration in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

Answer:

Box 1: Cash discount -

Cash discounts are setup and shared for Accounts payable and Accounts receivable. The cash discount available can be defined on the customer invoice or vendor invoice, and will be taken if the invoice is paid within the cash discount date.

Box 2: Payment fee -

You can create payment fees for customer payments.

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/cash-bank-management/cash-discounts

A client uses Dynamics 365 Finance for accounts receivable.

You need to ensure that accounts receivable clerks add the wire number for electronic payments.

Which item should you set up as mandatory in the method of payment?

Answer:

A

Enter the Bank transaction type to identify the type of payment used by your bank. The bank transaction type is used during the bank reconciliation process, and can make reconciliation easier.

Incorrect:

Not B: In the Method of payment field, enter an ID for the method of payment. The Method of payment ID is shown on invoices and payments, so make it descriptive enough to understand what type of payment is being recorded, and for what bank account.

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/accounts-receivable/tasks/establish-customer-method-payment

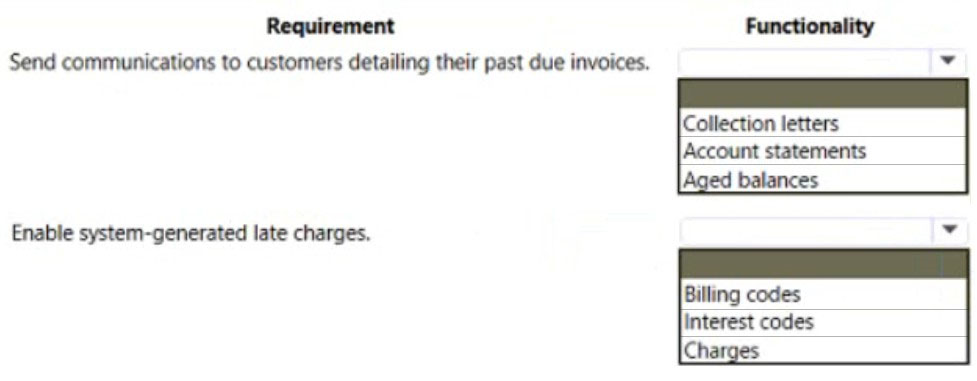

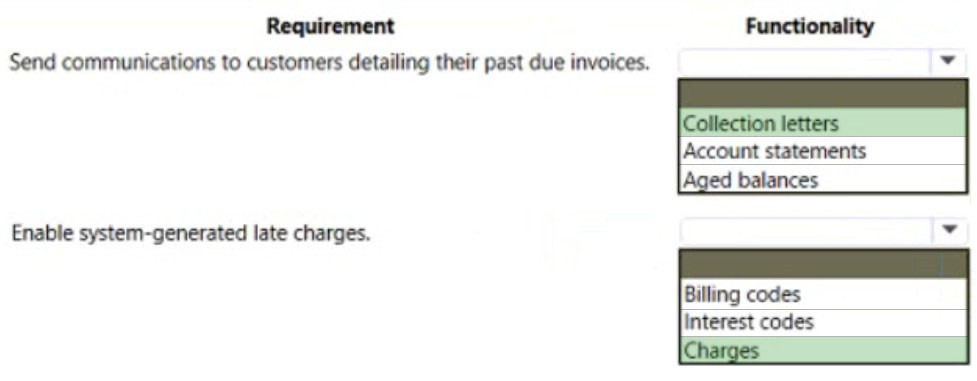

HOTSPOT -

You are implementing Dynamics 365 Finance.

You must manage aging customer balances by sending communications to the customers detailing their past due invoices and automatically including a late charge.

You need to configure Dynamics 365 Finance functionality.

How should you configure the functionality? To answer, select the appropriate options in the answer area.

NOTE: Each correct selection is worth one point.

Hot Area:

Answer:

Box 1: Collection letters -

Control collection letters at the customer level

If collection letters are set up at the transaction level, multiple letters might be generated for a customer, based on transaction aging. If transactions appear in different letter sequences, separate collection letters will be generated for each group of overdue transactions for the customer. Therefore, an individual customer might receive, for example, one collection letter for transactions that are 60 days overdue and another collection letter for transactions that are 90 days overdue.

Incorrect:

* Not Aged balances

View the balances on the Aged balances list and on the Collection page

Go to Credit and collections > Collections > Aged balances. The list page shows the balances for the customer. The aging icon shows the aging period for the oldest transaction.

Select a customer with a balance.

Expand the Aging fact box area to view the aged balances. The aging period definition for the fact box is taken from the default aging period definition specified in the parameters. You can change it using the Collect menu.

Recommended content -

Create a free text in -

Box 2: Charges -

To define auto charges by channel in Commerce, follow these steps.

1. Go to Accounts receivable > Charges setup > Auto charges.

2. Etc.

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/accounts-receivable/tasks/process-collection-letters https://docs.microsoft.com/en-us/dynamics365/commerce/auto-charges-by-channel

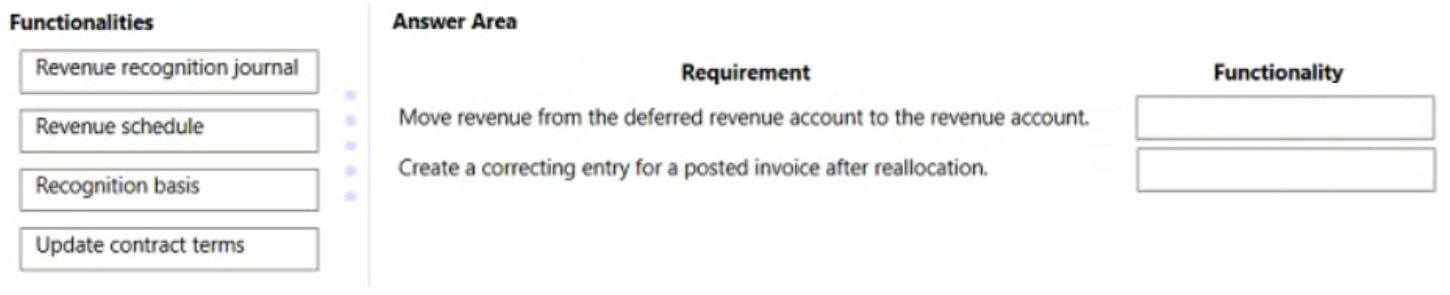

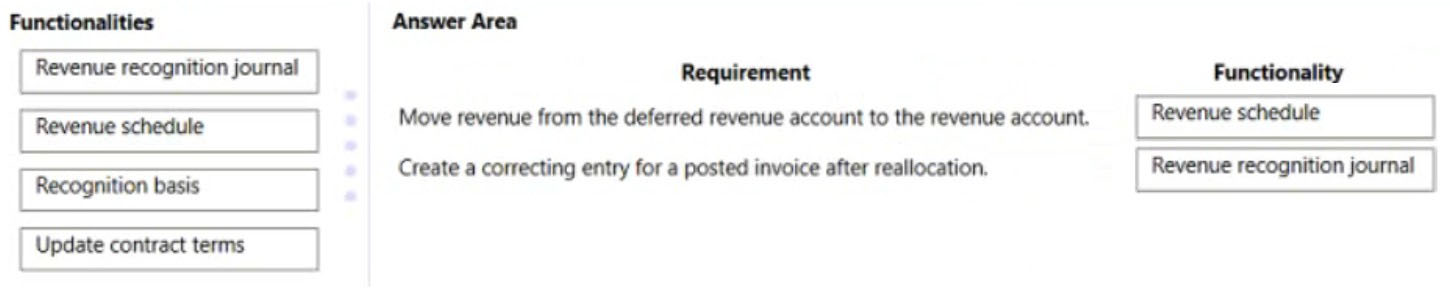

DRAG DROP -

A company is implementing Dynamics 365 Finance.

The company needs the ability to handle deferring revenue, reallocations, revenue schedules, and milestone-based recognition.

You need to configure the functionality.

What should you do? To answer, drag the appropriate functionality to the correct requirement. Each functionality may be used once, more than once, or not at all.

You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

Select and Place:

Answer:

Box 1: Revenue schedule -

In general, the revenue recognition process can be used to perform these tasks:

Allocate revenue, to help ensure that the appropriate revenue price is recognized, based on the value of the components on multi-element orders.

Defer revenue, based on a revenue schedule that represents the contractual time frame and percentages for recognizing revenue over time.

Box 2: Revenue recognition journals

A new journal type has been introduced for revenue recognition. The journal is required and is used in two scenarios.

The first scenario occurs.

The second scenario occurs when a journal is created after reallocation occurs. Reallocation occurs when a sales order line is added to a previously invoiced sales order, or when a new sales order is created that includes a line that is part of the original contract. If an invoice was posted before the new sales order line is added, a correcting accounting entry must be created for the posted customer invoice.

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/accounts-receivable/revenue-recognition-overview https://docs.microsoft.com/en-us/dynamics365/finance/accounts-receivable/revenue-recognition-setup

A cable and internet company implements Dynamics 365 Finance.

The primary line of business for the company is internet services. The company also sells routers and modems to customers for an additional one-time cost.

You need to configure revenue recognition.

What should you configure?

Answer:

B

Essential ג€" The item is a primary source of an organization's revenue. This value is the default setting.

Nonessential ג€" The item isn't a primary source of an organization's revenue. When the median price settings are used, the price is 'carved out' to the median price and then allocated.

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/accounts-receivable/revenue-recognition-setup

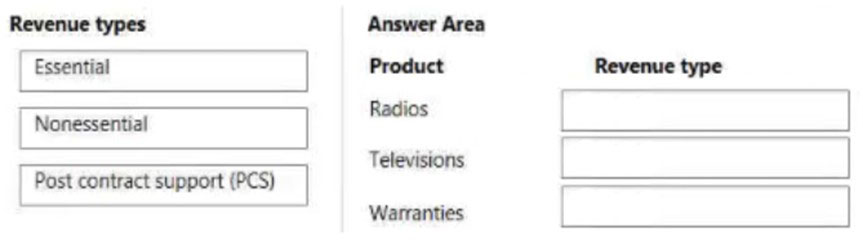

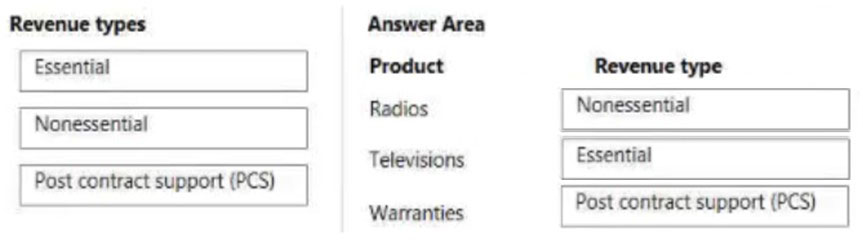

DRAG DROP -

You are configuring Microsoft Dynamics 365 Finance. Your company sells televisions, radios, and warranties. Televisions are considered the primary revenue source. You enter a sales order and add the three products. A discount is applied on the order.

Televisions must have a fixed price for revenue recognition. The revenue of warranties must be allocated to all televisions. Any remaining discount can be applied by using the radios. Released products must be configured so that applied discounts will have the requested impact on the revenue recognition.

You need to configure the released products.

Which revenue type should you use? To answer, drag the appropriate revenue type to the correct products. Each revenue type may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

Select and Place:

Answer:

Box 1: Nonessential -

Nonessential ג€" The item isn't a primary source of an organization's revenue. When the median price settings are used, the price is 'carved out' to the median price and then allocated.

Box 2: Essential -

Essential ג€" The item is a primary source of an organization's revenue. This value is the default setting.

Box 3: Post contract support (PCS)

Post contract support ג€" The item supports other elements that are included in the sale to the customer. The revenue price is distributed across the essential and nonessential products that are included in the sale. Depending on setup, PCS items might not require that contract start and end dates be defined on the sales order line.

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/accounts-receivable/revenue-recognition-setuphttps://docs.microsoft.com/en-us/dynamics365/ finance/accounts-receivable/revenue-recognition-setup

A company uses Microsoft Dynamics 365 Finance. You create revenue allocation schedules for items.

You need to link a revenue allocation schedule to an item.

Which two pages should you use? Each correct answer presents a complete solution.

NOTE: Each correct selection is worth one point.

Answer:

AC

On the Setup basis page, add a record for each item group that the item is supporting. When the revenue allocation occurs, the revenue price will be distributed across the essential and nonessential parts for the PCS item.

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/accounts-receivable/revenue-recognition-setup

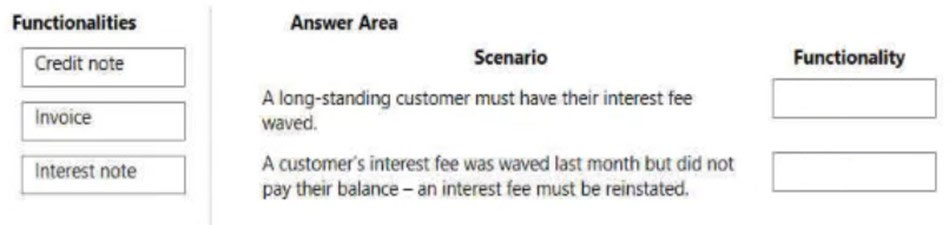

DRAG DROP -

You have implemented Dynamics 365 Finance.

You must implement interest fees to encourage customers to pay on time.

You need to configure interest fees.

Which functionality should be configured? To answer, drag the appropriate functionality to the correct scenario. Each functionality may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

Select and Place:

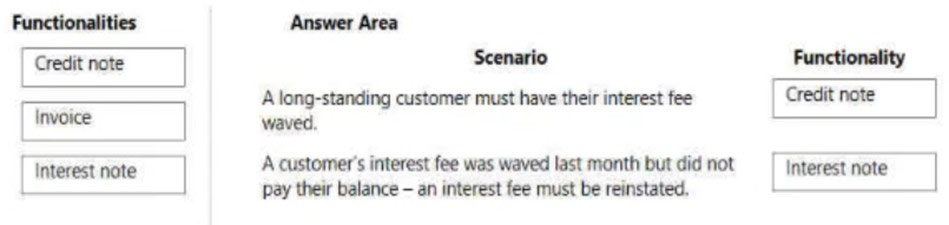

Answer:

Box 1: Credit note -

You use the Create credit note page to prepare a credit note for a customer when the customer returns items that have been ordered and received. A credit note is an invoice with a negative amount.

Box 2: Interest note.

An interest note is a business document that informs customers when interest or fees have been charged to their account. When you waive or reverse interest or fees, a credit note or adjustment invoice is automatically created to settle the charges.

Reference:

https://docs.microsoft.com/en-us/dynamicsax-2012/appuser-itpro/prepare-a-credit-note https://docs.microsoft.com/en-us/dynamics365/finance/accounts-receivable/waive-reinstate-reverse-interest-fees

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

You are managing credit and collections.

You need to set up mandatory credit limits for all customer documents.

Solution: Define a credit limit for each customer and select the Mandatory credit limit check box on the Customers form.

Does the solution meet the goal?

Answer:

B

Instead: Solution: Select the Balance + All credit type in the Accounts receivable parameters form.

Select the Mandatory credit limit check box in the Customers form.

Note:

Select from the following options:

None ג€" Do not check credit limits. You can override this option for a specific customer by selecting the Mandatory credit limit check box in the Customers form. If you do this, the credit limit is checked against the customer balance.

Balance ג€" The credit limit is checked against the customer balance.

Balance + packing slip or product receipt ג€" The credit limit is checked against the customer balance and deliveries.

Balance + All ג€" The credit limit is checked against the customer balance, deliveries, and open orders.

Reference:

https://docs.microsoft.com/en

Note: This question is part of a series of questions that present the same scenario. Each question in the series contains a unique solution that might meet the stated goals. Some question sets might have more than one correct solution, while others might not have a correct solution.

After you answer a question in this section, you will NOT be able to return to it. As a result, these questions will not appear in the review screen.

You are managing credit and collections.

You need to set up mandatory credit limits for all customer documents.

Solution: Select the Balance + packing slip credit type in the Accounts receivable parameters form.

Select the Mandatory credit limit check box in the Customers form.

Does the solution meet the goal?

Answer:

B

Instead: Solution: Select the Balance + All credit type in the Accounts receivable parameters form.

Select the Mandatory credit limit check box in the Customers form.

Note:

Select from the following options:

None ג€" Do not check credit limits. You can override this option for a specific customer by selecting the Mandatory credit limit check box in the Customers form. If you do this, the credit limit is checked against the customer balance.

Balance ג€" The credit limit is checked against the customer balance.

Balance + packing slip or product receipt ג€" The credit limit is checked against the customer balance and deliveries.

Balance + All ג€" The credit limit is checked against the customer balance, deliveries, and open orders.

Reference:

https://docs.microsoft.com/en