A company has many customers who are not paying invoices on time.

You need to use the collection letter functionality to manage customer delinquencies.

What are two possible ways to achieve the goal? Each correct answer presents part of the solution.

NOTE: Each correct selection is worth one point.

Answer:

BD

Reference:

http://d365tour.com/en/microsoft-dynamics-d365o/finance-d365fo-en/collection-letters/

A company plans to allocate revenue across occurrences by using recognition basis.

Which recognition basis can you use?

Answer:

D

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/accounts-receivable/revenue-recognition-setup

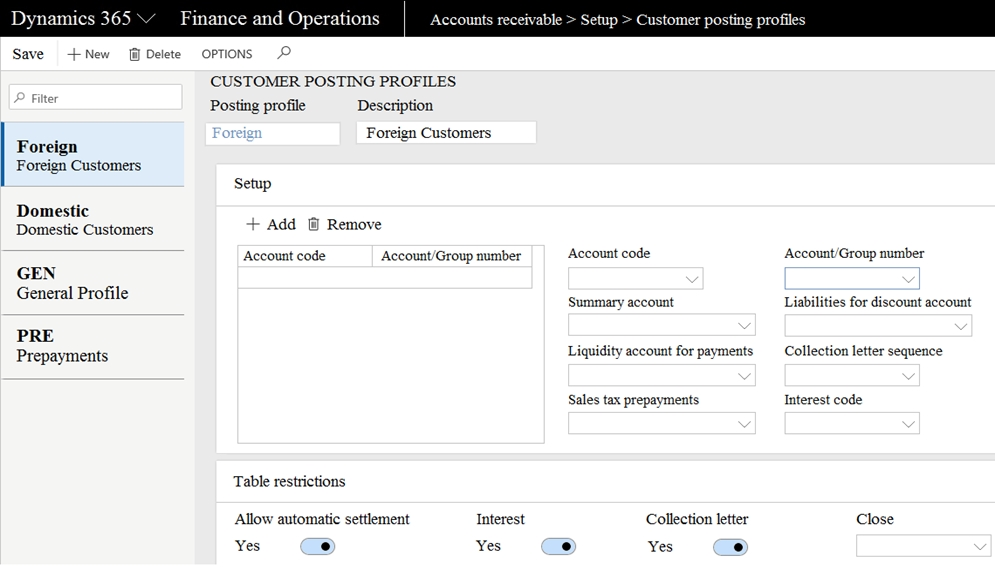

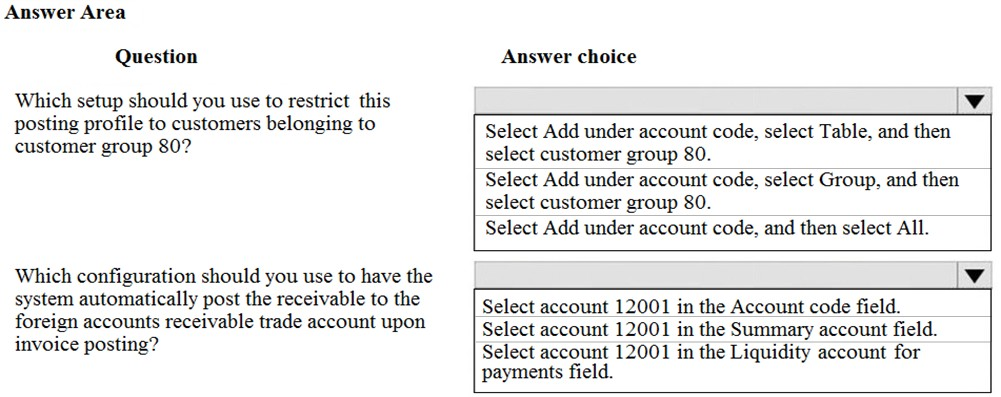

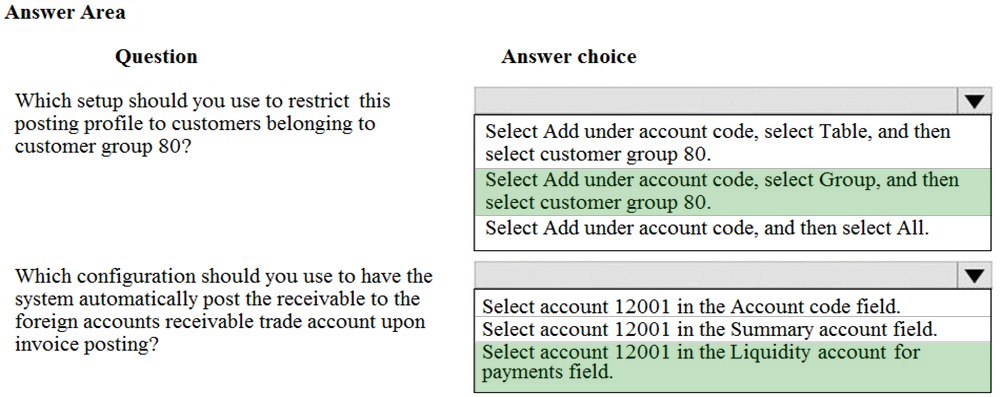

HOTSPOT -

A client is using Dynamics 365 Finance for sales order processing and accounts receivable. The client has two customer groups and two Accounts receivable trade accounts. Foreign customers in Group 80 are assigned to account 12001. Domestic customers in Group 40 are assigned to account 12000.

You are viewing the client's current setup of Customer posting profiles.

Use the drop-down menus to select the answer choice that answers each question based on the information presented in the graphic.

NOTE: Each correct selection is worth one point.

Hot Area:

Answer:

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/accounts-receivable/customer-posting-profiles

SIMULATION -

You are a functional consultant for Contoso Entertainment System USA (USMF).

You plan to run several reports in USMF that list all the write-off transactions.

You need to replace the write-off reason used by the system for USMF to use a reason of `Bad debts.

To complete this task, sign in to the Dynamics 365 portal.

Answer:

See explanation below.

You need to add a write-off reason for USMF and set it as the default.

1. Go to Navigation pane > Modules > Credit and collections > Setup > Accounts receivable parameters.

2. Click the Collections tab.

3. Click the Edit icon in the Write-Off section.

4. Add a new Write-Off reason if it doesn't exist.

5. Tick the ג€Defaultג€ checkbox next to the new Write-Off reason.

6. Click the Save button to save the changes.

A company signs a four-year contract for an IT support project. The manager wants to know how the revenue amounts will be allocated across the four-year period.

You need to implement a revenue schedule to determine the revenue amounts for each month.

Which setup should you use?

Answer:

B

Revenue schedules -

A revenue schedule must be created for each occurrence that revenue can be deferred for. For example, if your organization offers support over six-month, 12- month, 18-month, and 24-month periods, you must create a revenue schedule for each period.

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/accounts-receivable/revenue-recognition-setup

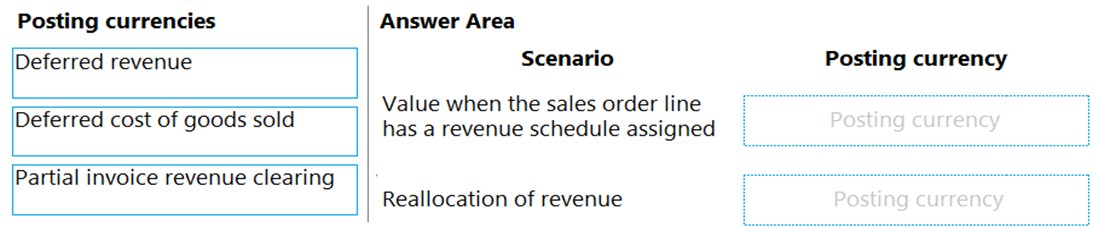

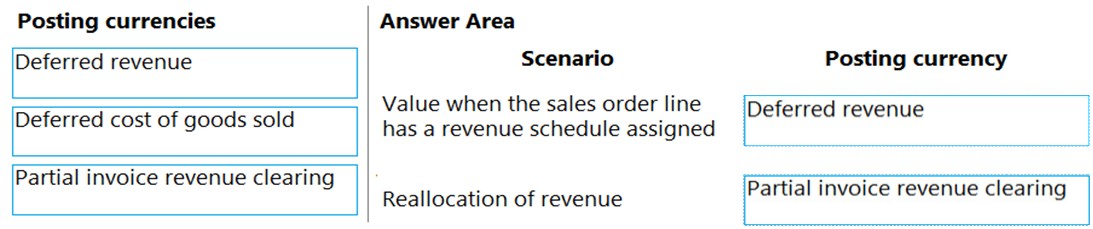

DRAG DROP -

You have implemented Dynamics 365 Finance.

You must configure revenue recognition to handle deferring revenue and revenue reallocation.

You need to configure the posting profile.

What should you do? To answer, drag the appropriate posting profiles to the correct scenario. Each posting profile may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

Select and Place:

Answer:

Box 1: Deferred revenue -

Deferred revenue ג€" Enter the main account for the revenue price that posts to deferred revenue (instead of revenue). The revenue price is deferred if the sales order line has a revenue schedule.

Box 2: Partial invoice revenue clearing

Partial invoice revenue clearing ג€" Enter the main account for the clearing account that is used either when the sales order is partially invoiced or when reallocation occurs. The balance in this account returns to 0 (zero) when the sales orders are fully invoiced.

Incorrect:

Deferred cost of goods sold ג€" Enter the main account for the cost of goods sold amount that posts to deferred cost of goods sold if the revenue is also deferred.

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/accounts-receivable/revenue-recognition-setup

A company plans to allocate revenue across occurrences by using recognition basis.

Which recognition basis can you use?

Answer:

D

Recognition basis ג€" The recognition basis determines how the revenue price is allocated across the occurrences.

* Monthly ג€" The amount is allocated equally across the number of months that is defined in the Monthly by days ג€" The amount is allocated based on the actual days in each calendar month. occurrences.

* Etc.

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/accounts-receivable/revenue-recognition-setup

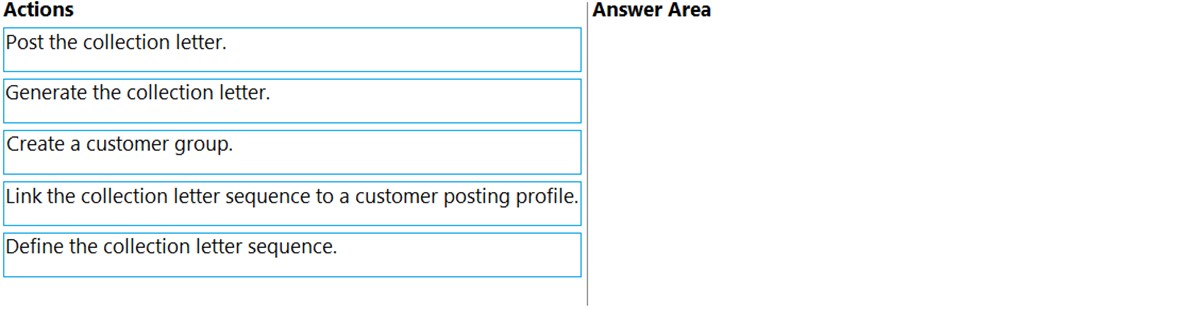

DRAG DROP -

You manage customer credit and collections in a Dynamics 365 Finance implementation.

At the beginning of each month, you must send collection letters to customers whose payments are overdue.

You need to configure the collection letter functionality.

Which four actions should you perform in sequence? To answer, move the appropriate actions from the list of actions to the answer area and arrange them in the correct order.

Select and Place:

Answer:

Step 1: Define the collection letter sequence.

Set up a collection letter sequence on the posting profile

Step 2: Link the collection letter sequence to a customer profile.

Step 3: Post the collection letter.

See step 9 below.

Print collection letters -

1. Go to navigation pane > Modules > Credit and collections > Collection letter > Review and process collection letters.

2. In the Status field, select Created.

3. In the Printed field, select Not printed.

4. Select Print.

5. Select Collection letter note.

6. In the Parameters section, enter the cutoff date for postings.

7. Expand the Records to include section and enter the details of the Collection letter note.

8. Select OK to print the collection letter.

9. Post the collection letter. Etc.

Step 4: Generate the collection letter.

Each collection letter is also associated with a collection letter code. The collection letter code is associated with individual transactions and is used to determine when the next collection letter should be generated for each transaction. For example, if a transaction is more than 30 days overdue, the collection letter code determines that the next collection letter will be sent when the transaction becomes 60 days overdue, if it isn't paid before then.

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/accounts-receivable/tasks/process-collection-letters

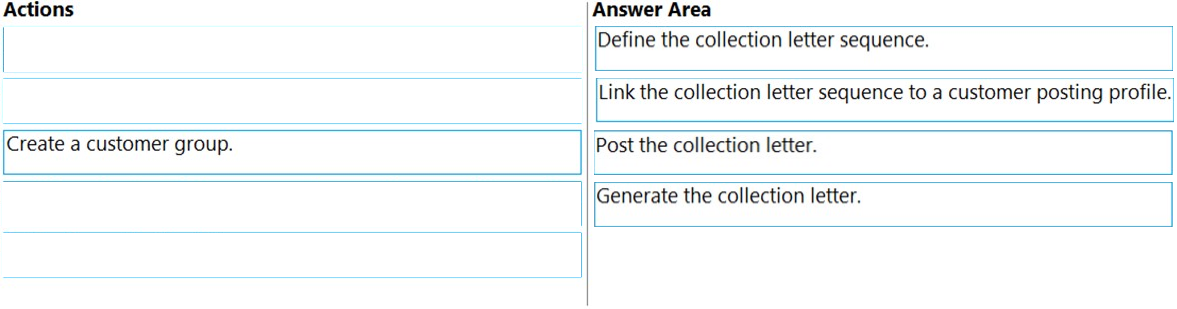

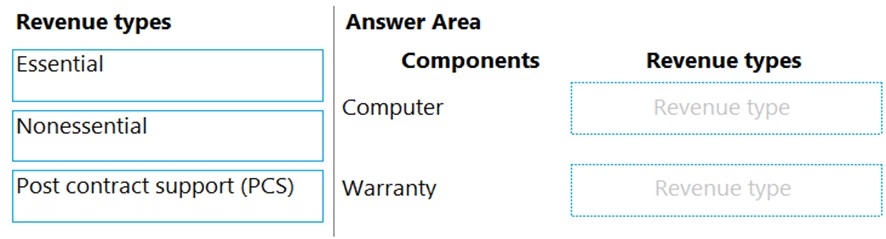

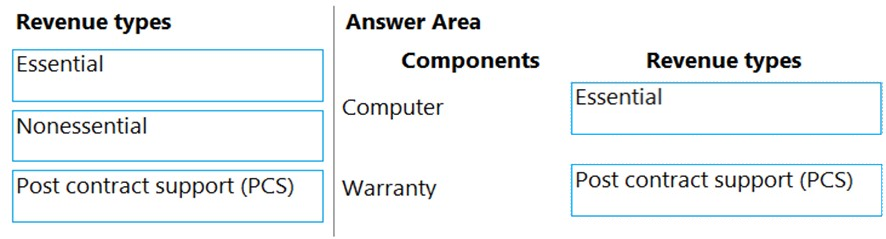

DRAG DROP -

A company that sells computer equipment uses Microsoft Dynamics 365 Finance. The company is creating bundles that include a computer and a three-year warranty.

The company configures revenue recognition.

You need to configure revenue types for the bundle components.

Which revenue type should you use? To answer, drag the appropriate revenue types to the correct components. Each revenue type may be used once, more than once, or not at all. You may need to drag the split bar between panes or scroll to view content.

NOTE: Each correct selection is worth one point.

Select and Place:

Answer:

Box 1: Essential -

Essential ג€" The item is a primary source of an organization's revenue. This value is the default setting.

Box 2: Post contract support (PCS)

Post contract support ג€" The item supports other elements that are included in the sale to the customer. The revenue price is distributed across the essential and nonessential products that are included in the sale. Depending on setup, PCS items might not require that contract start and end dates be defined on the sales order line.

Reference:

https://docs.microsoft.com/en-us/dynamics365/finance/accounts-receivable/revenue-recognition-setup

You maintain account control and bank balances for a company. You have a $100,000 credit limit from a bank.

You must prevent the bank account from going below the defined credit limit when a transaction is posted.

You need to configure the bank account credit limit.

What should you do?

Answer:

A

Set up a bank account credit limit (see step 7 below).

Use the Bank accounts form to enter a valid bank account number, routing type, and routing number, and enter your cash credit or overdraft limit for payment transactions.

1. Click Cash and bank management > Common > Bank accounts.

2. Click Bank account to open the Bank accounts form.

3. In the Bank account field, enter the unique bank account number. Enter the name of the bank in the Name field.

4. In the Routing number type field, select the routing number type as FW, CP, or CH.

5. In the Routing number field, enter the routing number for the bank. The routing number is validated based on the routing type selected.

6. In the Bank account number field, enter a bank account number that contains 7 to 14 digits.

7. In the Credit limit field, enter the credit limit. This is a negative number.

8. Close the form to save your changes.

Reference:

https://docs.microsoft.com/en-us/dynamicsax-2012/appuser-itpro/usa-create-a-payment-journal-and-validate-the-credit-limit-for-a-bank